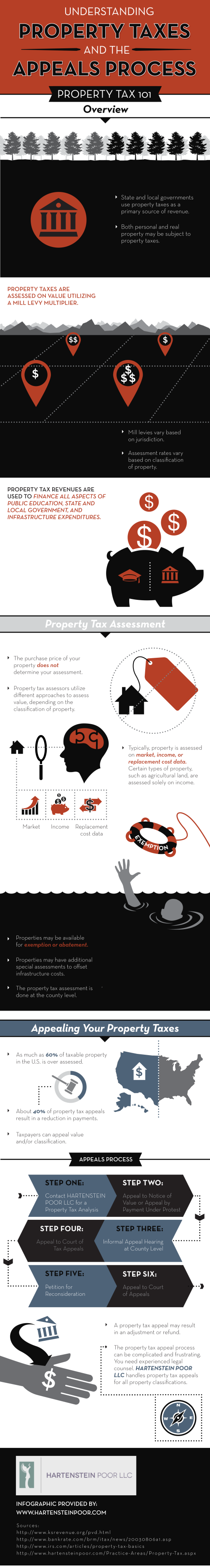

Property taxes have been around for many years, with evidence showing that even ancient civilizations levied taxes on property owners. While much has changed since ancient times, homeowners are still required to pay property taxes that are dependent on a property’s assessed value. Property taxes can be calculated in a few different ways, but research shows that as much as 60% of taxable property in the country is assessed at more than it is actually worth. If you think your property taxes are unreasonable, trust Hartenstein Poor LLC, property lawyers near Wichita , to help you through the appeals process. Approximately 40% of appeals result in a reduction of fees or a refund, so protesting your taxes could pay off. Take a look at this infographic to understand more about the basics of property taxes and why you should consider appealing. Please share with your friends and neighbors.